From physics to finance

In new book, professor explores scientists’ role on Wall Street

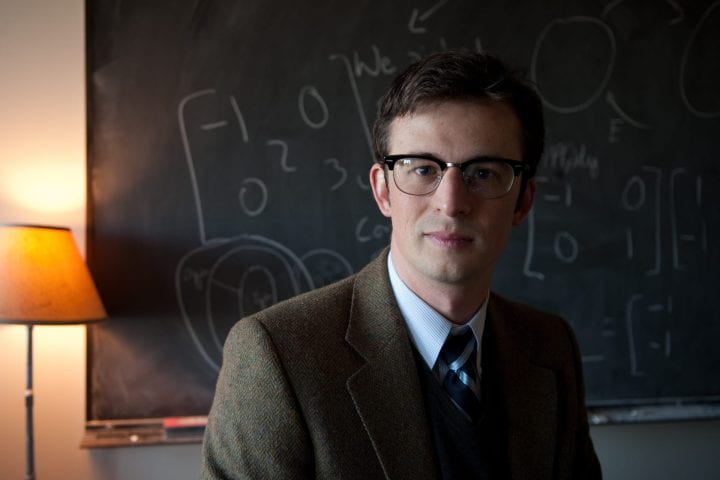

When U.S. markets crashed in 2008, James Weatherall was completing his doctorate in mathematics and physics less than five miles from Wall Street. A financially strapped grad student, he didn’t have a monetary interest at stake but was keenly interested in the crisis’s genesis.

“Derivatives, these complicated financial products that require the use of mathematical models to understand, seemed to be at the heart of the collapse,” says Weatherall, now an assistant professor of logic & philosophy of science at UC Irvine.

Finger-pointing put the mathematicians and physicists behind these models in the spotlight as financiers and others called into question scientists’ place in the financial world. With Harvard physics and philosophy degrees under his belt and his first Ph.D. in sight, Weatherall couldn’t stay out of the fray.

“The only way you can pull down the national economy is if you work for one of these multibillion-dollar hedge funds,” he says. “If, as critics claimed, physicists couldn’t possibly know what they were doing in finance, if it was so obvious, how did they get their jobs in the first place?”

Over the next four years, the notion of how ideas and practices move from physics to finance was never far from Weatherall’s mind. He earned an M.F.A. in creative writing at Fairleigh Dickinson University and his second doctorate, this one in logic & philosophy of science at UC Irvine, and somehow found time to write a book on the topic.

The Physics of Wall Street, which hit shelves this month, explores 100 years of the most creative, clever and unlikely players in the financial world – those who, according to Weatherall, “just had a swashbuckling instinct to do cool new things with the tools they were trained to use.

One such entrepreneur is fellow Anteater Edward Thorp. One of UC Irvine’s early mathematics professors, he applied his expertise in statistics and probability theory to card counting, earning himself a small fortune and inaugural membership in the Blackjack Hall of Fame. After besting casinos in Reno, Tahoe and Vegas, Thorp put his models to work on Wall Street, creating the quantitative hedge fund.

The mathematician-turned-card shark-turned hedge fund manager is one of several examples Weatherall cites as he explains how practices that weren’t natural fits in the financial domain have become critical – and extraordinarily successful – components in money managing and investing.

“Mathematicians and physicists attack a difficult problem by simplifying assumptions and trying to get some solution, even if it’s not final,” he says.

The kinds of models produced are perfectly legitimate and useful, Weatherall says, but trouble can arise when they’re taken out of the hands of experts trained to understand their inherent risks.

“Models are approximations, and they’re based on assumptions that don’t always hold. But it can be very easy for people not used to building models to look at these equations and believe they tell you the whole truth about markets,” he says. “They need to be used cautiously; otherwise, they tend to engender overconfidence.”

Weatherall argues that more time and resources need to be devoted to studying these unorthodox applications of math and physics in new realms – and that as such models are adopted more widely, the scientists needed to run them can’t be left out of the mix.

Asked if he sees himself among this future crew of Wall Street academics, Weatherall says he’d rather focus his time and energy on symmetries in particle physics and gravitational theories. He and his wife also have their hands pretty full with twin daughters born in November.

Newly released, The Physics of Wall Street has been reviewed in The New York Review of Books and will be an upcoming New York Times “Editors’ Choice.” The book was a Daily Beast “Hot Read” the first week of January and was featured by The Barnes & Noble Review.

Weatherall will sign copies of his book at 7 p.m. Thursday, Jan. 10, at the Tustin Barnes & Noble, at 13712 Jamboree Road.