What’s next in real estate?

Ed Coulson, director of UCI’s Center for Real Estate, examines current trends which suggest lower interest rates

In mid-October 2023, mortgage rates reached their highest level in over two decades. Combined with a low inventory of homes for sale, last year proved to be a challenging real estate market for homebuyers.

What led to the challenges in the real estate market? Will home prices continue to rise in 2024? What will we see happen with mortgage rates? How are renters also impacted?

After a deep analysis of many of the trends impacting our community and the nation, Ed Coulson, professor of economics at the Paul Merage School of Business and director of UCI’s Center for Real Estate, provides some answers.

How has the demand for housing changed over the last few years?

It starts, as economic stories now always do, with the pandemic. The onset of the COVID-19 outbreak caused upheaval over many dimensions of life. Seemingly overnight, our preferences over our housing arrangements changed. The preference for living alone increased, but the demand for space also increased. People worked from home and needed to create space for that activity. Figure 1 (in the graphic below) shows the change in number of households in the U.S. over the past decade. Three million new households were created from 2020 to 2022, a two-year change that is very large by historical standards.

Figure 1 (Source: U.S. Census Bureau)

All of this increases the demand for housing in a very fundamental way. In the short run, supply is fixed in place. A truism of real estate is that building stuff takes time, and so when housing demand rises autonomously, as it did during the pandemic, the price of housing will rise.

How did the increase in housing demand translate into increased real estate prices?

Housing prices can be evaluated by examining two elements: monthly rent and purchase price. Housing demand is most fundamentally reflected in rents because this is the price for actual housing consumption. Home prices reflect both this consumption motive and the investment potential, which involves other things, particularly interest rates.

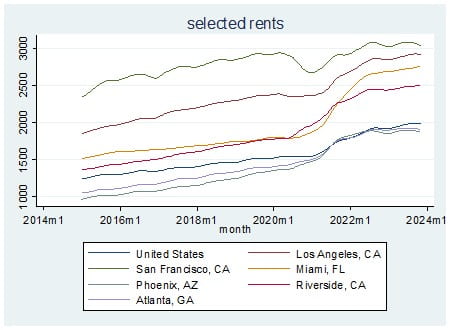

To the extent that these new households are renters, we would expect rents to accelerate as the pandemic unfolded, and new households were formed. This came to pass. There was a sharp acceleration in rents beginning in late 2021 and – after a brief pause in early 2022 – they resumed their upward climb, though this second climb was not quite as dramatic, as seen in Figure 2 (below).

Figure 2 (Source: Zillow)

Housing prices will follow the trend of rents to a certain extent because the value of housing as a commodity has risen. But as an asset, homes will also be expected to correlate with interest rates. More specifically, the desire to buy a home – as opposed to renting a home – will be a function of the mortgage interest rate.

Figure 3 (Source: Zillow)

As mentioned, rental inflation paused at the beginning of 2022. As seen above in Figure 3, home prices actually fell at roughly the same time, as the market reacted to the run-up in mortgage rates. Figures 2 and 3 both demonstrate the remarkable similarity of house price cycles across U.S. cities in the post-pandemic era.

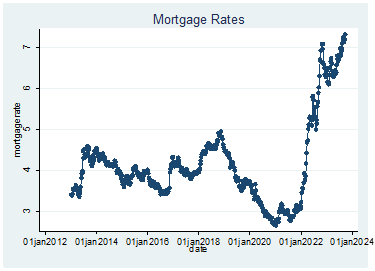

Figure 4 (below) shows the very quick rise in the 30-year fixed mortgage rates from a low of about 3% during the pandemic to around 7% right now.

Figure 4 (Source: Federal Reserve Economic Data)

What caused this very steep rise in mortgage rates and what is the fallout?

The steep rise in mortgage rates correlated with an increase in the shorter-term interest rates that are largely governed by the actions taken by the Federal Reserve. Figure 5 (below) reflects the Federal Funds rate (in red), which is the rate at which the government lends to member banks, in contrast with changes in the 30-year mortgage rate.

The Fed had kept rates on the low side even before the pandemic. But fearful of economic fallout as the pandemic and the accompanying restrictions on economic activity took hold, it cut the rate to near zero again in March 2020.

However, the pandemic also produced inflation, initially largely because of the disruption of the supply chain, with a contribution from the stimulus payments to households. The government measure of inflation rose to almost 8%. In response, the Fed raised short-term rates to stifle the economy and lower inflation.

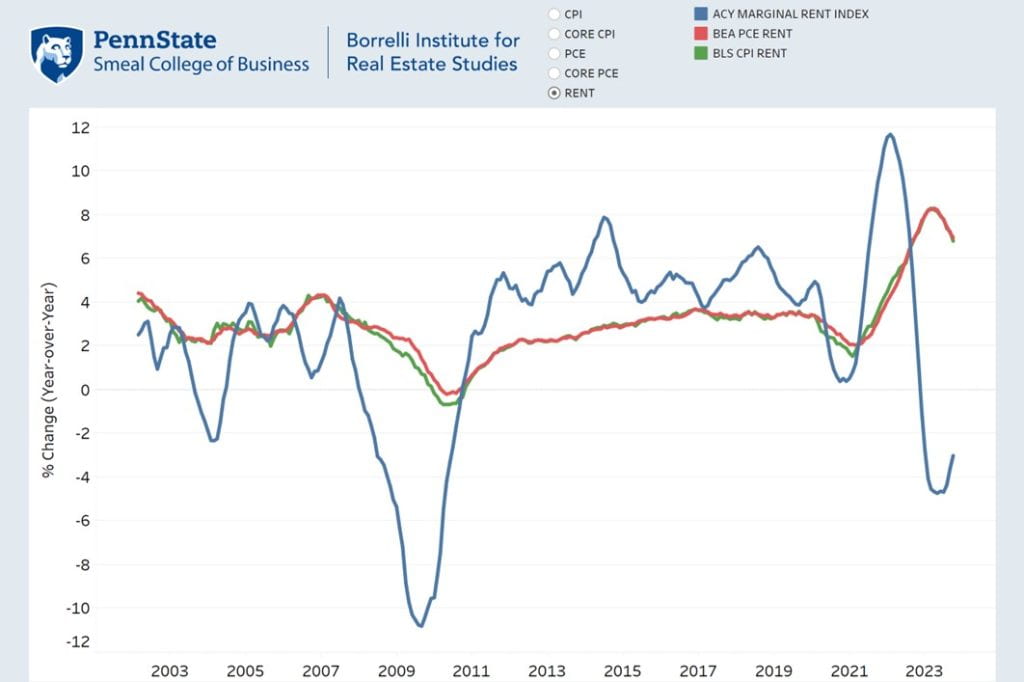

Research I conducted with Brent Ambrose and Jiro Yoshida of Penn State shows that the official measures of inflation are mistaken, which led to a mistiming of Fed policy. In particular, we show that the data that the Fed uses to measure rental inflation lags the actual activity in the housing market by several months.

This information is summarized on the website (https://sites.psu.edu/inflation) and displayed in Figures 6 and 7 (below). Figure 6 demonstrates that current rental inflation is basically zero.

Figure 6 (Source: https://sites.psu.edu/inflation/)

Figure 7 displays the result of replacing the Fed’s faulty rental measure with our contemporaneously measured one. As you can see, our measure of inflation is also basically zero.

Figure 7 (Source: https://sites.psu.edu/inflation/)

We have observed a reduction in inflation over the past few months – even by the Fed’s measure – and the Fed’s most recent announcement (as of Dec. 13, 2023) has seemingly acknowledged that we can confidently forecast, absent any severe shock, further reduction in the inflation because its measure of rental and overall inflation will catch up to ours.

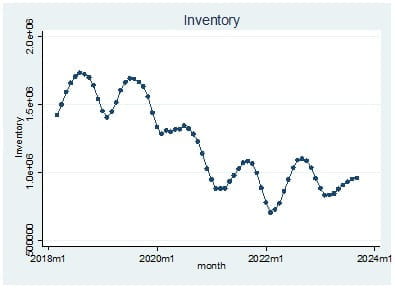

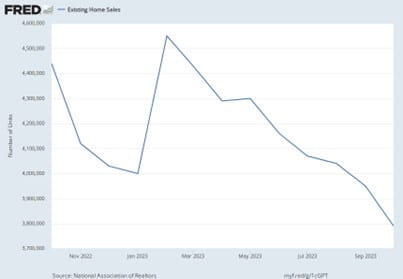

In the meantime, the impact on the housing market has been substantial. The issue is that with the rise in mortgage rates, buying a home has become more difficult. Even existing homeowners will be reluctant to improve or right-size their dwelling unit. A substantial portion of homeowners purchased their property by acquiring a mortgage loan with a low rate (in the 3-5% range seen in the recent history). A new home, however, would have to be financed by a mortgage with a much higher rate. As a result, both supply and demand for new homes are choked off by this problem of “mortgage lock.” Figure 8 (below) shows the declining state of inventory for sale, and Figure 9 (below) features the declining number of sales.

Figure 8 (Source: Zillow)

What trends are real estate experts forecasting we’ll see in 2024?

Fortunately, the Fed’s action on Dec. 13 has reduced a lot of the uncertainty. One thing I have to say about the current Fed, and Chairman Jerome Powell in particular, is that when they signal something, they follow through. They have done more than signal! They have announced a trio of rate cuts in the coming year. This is congruent with the story above about inflation. Moreover, it will eventually have an impact on the mortgage lock problem that has kept so many buyers from finding the right house.

The one thing that is puzzling is the timing of investor and homebuyer action. If people know that rate cuts are coming, won’t there be some delay? Why buy now if you know there is a lower mortgage rate in your future? Perhaps by announcing a series of cuts, the expectation is that housing and other investors will be drawn back gradually, thereby avoiding any overload on markets.

If you want to learn more about supporting this or other activities at UCI, please visit the Brilliant Future website at https://brilliantfuture.uci.edu. Publicly launched on Oct. 4, 2019, the Brilliant Future campaign aims to raise awareness and support for UCI. By engaging 75,000 alumni and garnering $2 billion in philanthropic investment, UCI seeks to reach new heights of excellence in student success, health and wellness, research and more. The Paul Merage School of Business plays a vital role in the success of the campaign. Learn more by visiting https://brilliantfuture.uci.edu/paul-merage-school-of-business/.