UCI expert discusses Fed rate cut

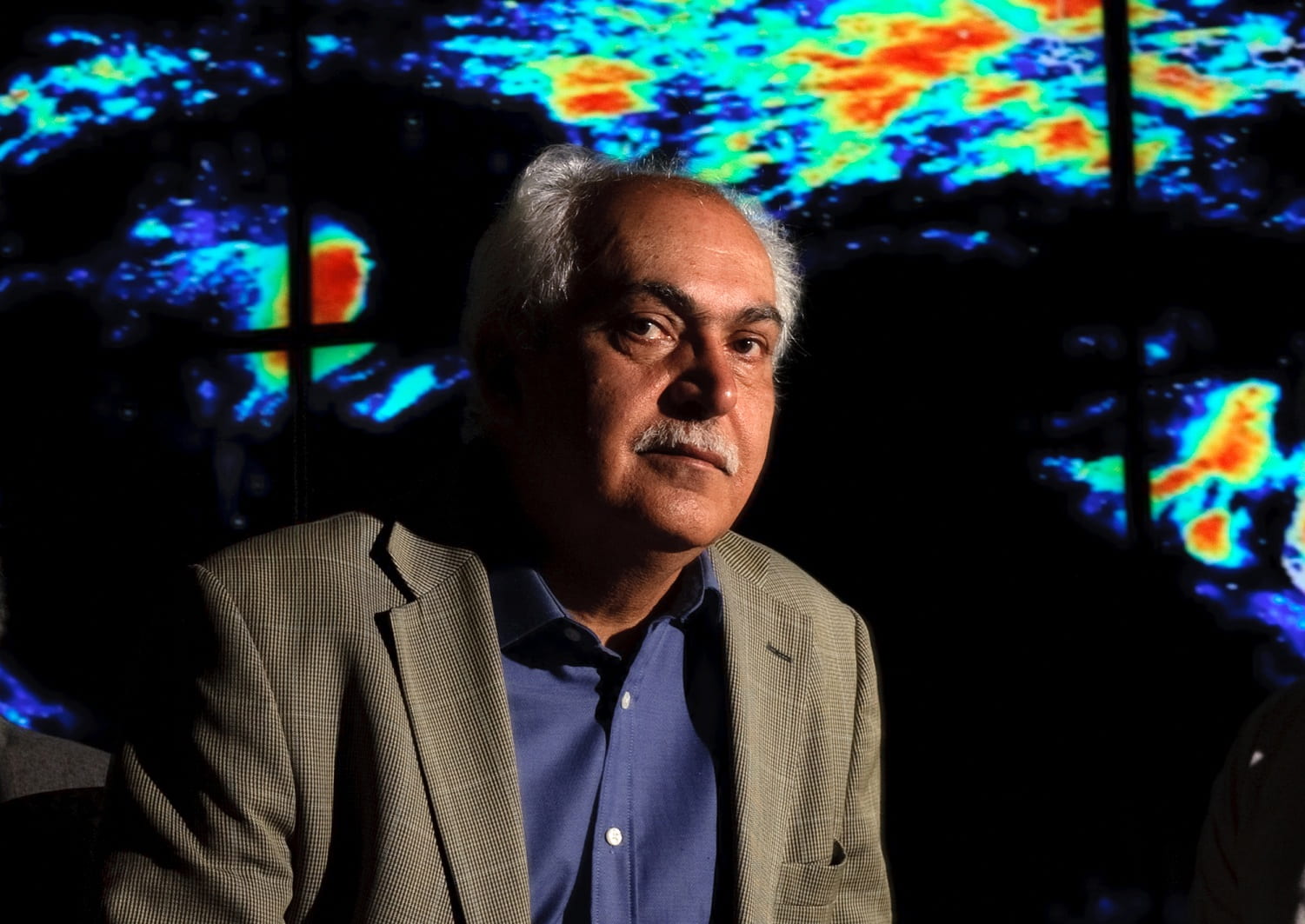

Business school professor Peter Navarro analyzes the Federal Reserve’s emergency interest rate cut

The Federal Reserve, in coordination with other central banks around the world, enacted an emergency interest rate cut Oct. 8 in response to worsening conditions in global financial markets. Peter Navarro, economics and public policy professor at UC Irvine’s Paul Merage School of Business, answers questions about its potential effectiveness.

Q: How is this different from the usual rate cut?

A: It is highly unusual in that it was coordinated with other central banks around the world. Coordination at this juncture is critical because the world runs the risk of countries engaging in ‘beggar thy neighbor’ – competitive devaluations of their currencies as a means of fighting their own domestic situations by boosting exports. Rate cuts indirectly act to devalue currencies because of their impact on foreign investment flows. Competitive devaluations were the trigger not just for the Great Depression but also World War II, so coordination was very important.

Q: Will it work?

A: The rate cut won’t stem the tide of recession because you can’t push on a string. That is, lower interest rates won’t elicit more investment if businesses think the economy is softening. The only choices now are either to let the markets and economy suffer the pain and rebound naturally or to engage in more Keynesian fiscal stimulus. The fiscal stimulus can’t be tax cuts because that money will go under mattresses and be saved rather than spent in this climate of fear. The stimulus must involve more government expenditures. This, too, is very risky given the already large budget deficit. Markets will likely remain in a downward trend.